If you’re working for an employer on 5th April, they must provide you with a P60. This must be given to you by 31st May, on paper or electronically.

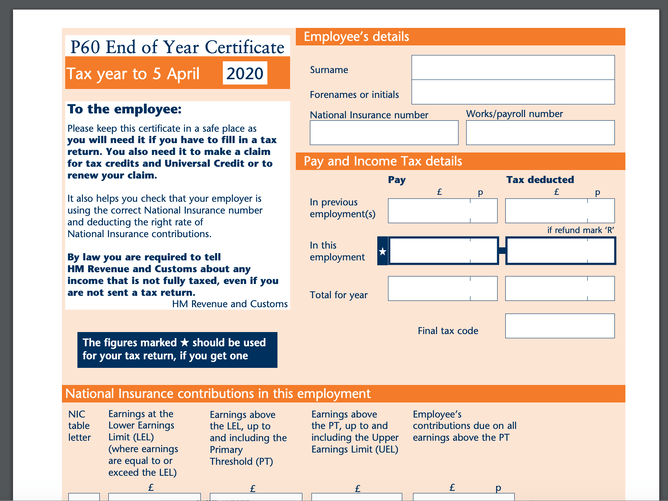

Your P60 shows the tax you’ve paid on your salary in the tax year (6th April to 5th April). It is a form showing all the money you’ve been paid in the tax year, along with all the tax and National Insurance Contributions (NICs) that have been taken out.

You will get a separate P60 for each of your jobs.

You should keep your P60 safe, it’s the simplest was to prove how much tax you’ve paid. The following are examples of what you need your P60 for:

- to claim back overpaid tax

- complete your Income Tax Self Assessment

- apply for tax credits

- proof of your income if you apply for a loan or a mortgage

- view any statutory benefits you may receive and verify it with your bank statements

- see how much of student loan has been deducted from your earnings if you live in the UK

- see how much you have received in statutory payments (EG Maternity Pay, Shared Parental Pay)

Reasons to check your P60:

- ensure your national insurance number is correct

- to see if your employer is deducting the correct rates (see below for information on what to do if you think you have paid too much tax)

- Your tax code is correct (more information on what a tax code is and what it means here)

You can get a replacement P60 from your employer.

Employees whose employer(s) use Cashtrak payroll service can obtain their P60 immediately from any year (since they have been a client of Cashtrak) from our payroll software.

You can check how much tax you paid last year by clicking here.