The ICB LUCA Awards Nominations 2024

Welcome To Our Digital Showcase!

We're thrilled to have you here! This webpage is designed to provide you with a comprehensive overview of Cashtrak's commitment to excellence in the field of bookkeeping. Explore our achievements, client testimonials, and supporting evidence to gain a deeper understanding of why we believe we are worthy of these prestigious award. Thank you for your time and consideration.

Our Team Outside The ICB Bookkeeping Summit With Big Ben

Witness the pride and accomplishment on Jo (2022) and Lorraine's (2023) faces as they receive the coveted Bookkeeper of the Year award. This well-deserved recognition is a testament to their exceptional skills, dedication, and unwavering commitment to our clients' financial success. Their achievement serves as a powerful inspiration for our entire team, motivating us to strive for excellence in all that we do.

Our clients certainly do say it best! Here you see what they think of our fantastic bookkeeping team.

Our commitment to the community extends beyond our clients. We are proud supporters of local football teams, demonstrating our dedication to fostering a thriving community spirit.

We sponsor the ball retrievers at our local football club, Wycombe Wanderers and the Wycombe Wanderers Foundation (WWF) which includes Wycombe Wanderers Women FC. WWF are the offical charity of Wycombe Wanderers Football Club which enables them to use their platform to positively address local issues. This includes sports participation, health & wellbeing, inclusion & cohesion and education & employability. Find out more about this very worthy charity by clicking here..

Thame United U15s Girls

And finally! We sponsor the Thame United U15 Girls, this is our second season of sponsoring the girls, we are proud to announce they were promoted from the B league to the A league for this season and they reached the final of the Oxfordshire cup competition last season, narrowly missing out and coming second in the competition. Two nearby teams had disbanded prior to last season and a number of girls joined the Thame United team so last season was the first season a lot of them had played together so to reach a final and promotion was an even more amazing success!

Melissa Humphrey, Centre Manager,

Wycombe Multicultural Organisation (W.M.C.O), Hilltop Community Centre:

‘We have worked with Cashtrak for 4 years and have been extremely pleased with their work.

‘I was completely new to employing people which meant that I wasn’t familiar with payroll and pensions, so they had to start from scratch with me, which meant a lot of handholding and support as they explained the processes to me.

‘They also gave me additional support in the form of training sessions on how to run a business which were extremely welcome.’

A Partnership That Lasts

At Cashtrak, we're more than just bookkeepers. We're trusted partners in financial success.

We're here to listen, help, and make our client's journey as seamless as possible.

Join us as we explore the transformative power of our bookkeeping services through these inspiring client journeys.

Client 1 – Alex Jarvis, Right Signs (High Wycombe) Ltd

Alex was put in contact with us by our current client, Trevor, who ran Right Signs as a sole trader and was selling the business to Alex. Alex who was in his early 20s, was employed at a cycling repair business, he’d never run his own business before. He had very limited experience in the industry, helping out Trevor on a few occasions.

During our initial meeting, we quickly assessed Alex's entrepreneurial spirit and determination. While he had sought advice from family and friends, he was unsure about the best course of action for his business.

We conducted multiple meetings with Alex, taking a patient approach to explain the intricacies of business setup and operation. Recognising that he was simultaneously learning sign writing techniques, we provided clear summaries of our progress and outlined the next steps.

Once we set the business up for Alex, we introduced him to additional services like payment systems and Modulr. Throughout this process, we provided ongoing guidance and support, responding promptly to his questions via phone, WhatsApp, and email. We learnt his preferred communication, wherever possible was Whats App so we use this to communicate with him. There were a LOT of VAT questions to start with!

Towards the end of his first financial year, Alex visited our office for a comprehensive review. As we are in frequent contact we know what he would want to see report wise so prepared a customised profit forecast and discussed the implications of his financial performance, which he found very helpful.

We appreciate working with clients like Alex, who are receptive to guidance and actively implement our recommendations. By establishing a solid foundation from the outset, we avoid costly errors and streamline the business setup process. Alex's willingness to ask questions and seek clarification has been instrumental in his success. We are delighted to see him thriving in his sign writing business.

Client 2 – Phil Higgins, Focus Fitness

Phil approached us three years ago seeking bookkeeping services for his newly established martial arts business, which he co-founded with a friend. Despite having a family friend as their accountant, they found limited responsiveness and sought our guidance.

As first-time business owners, Phil and his partner required extensive support. We guided them through various aspects of their business, including VAT exemption status, allowable business expenses, and compliance requirements.

As we do with all our clients, we asked how he preferred to communicate and found early on that emailing a report showing transactions without paperwork and then having a call to go through these was the most convenient for Phil. It meant Phil could locate the invoices and receipts there and then ensuring his finances were up-to-date.

See For Yourself!

Alex and Phil discuss their experiences with us and back us for the Client Experience Award here:

Client 3 Kate Mills, The Rainbow Healing Hub

Kate, a client of ours for five years, openly admits she doesn’t like paperwork. While she enjoys providing her healing coach services, she finds administrative tasks challenging. During our initial engagement, she was navigating a particularly stressful period, having recently separated from her partner and raising two young children.

We worked closely with Kate to understand her personal and professional goals, tailoring our approach to minimise her administrative burden while allowing her to focus on her personal life and business. Over time, our relationship has evolved to accommodate her need for frequent guidance and reminders. Kate prefers to communicate primarily through WhatsApp, and we provide her with a detailed list of transactions requiring supporting documentation. She responds to each item with a description, ensuring efficient and accurate bookkeeping.

In Kate’s own words:

“Carol and Stacey are a great team at Cashtrak. My accounts, I know are in good hands, all my queries are answered promptly and my end of year tax return taken care of. Makes life so much easier when you have a bookkeeper that are able to communicate the way you want to and don’t charge any extra for all the questions! Highly recommend!”

Personalised Bookkeeping, Personalised Success

Discover how Cashtrak supported a

young entrepreneur's journey

from startup to success

Watch how Cashtrak guided

young, ambitious friends

to a business triumph.

Witness firsthand how our bookkeeping services played a crucial role in the success of this martial arts business. Learn about our support in navigating complexities & achieving entrepreneurial goals with Phil.

Client Referrals: A Testament to Our Service

Experience the power of word-of-mouth. Explore our testimonials from clients who have recommended our bookkeeping services to others.

Staying Connected: Our Commitment to Our Clients

Even after our client's business outgrows our services, we remain dedicated to their success. Our commitment to staying connected ensures they're informed about updates we feel would be beneficial for them.

Click below to see our communication with an ex client.

Delivering Results, Exceeding Expectations

As you've explored our client testimonials and case studies, you've witnessed firsthand our unwavering commitment to delivering exceptional service. Our dedication to understanding our clients unique needs, providing personalised support, and going above and beyond has earned us a reputation as a trusted partner in their financial journey.

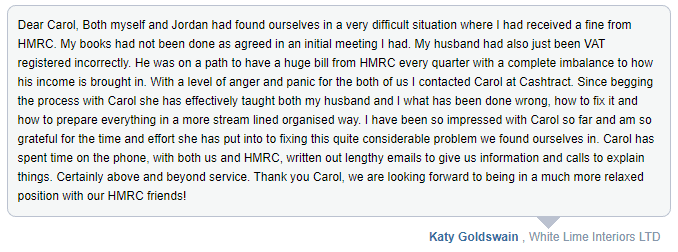

Katy Goldswain, White Lime Interiors

After launching her business, Katy sought the advice of an accountant who worked with other family members. While they were proficient in handling allowances and tax, she found the process overwhelming and confusing.

She initially engaged this accountant in February 2023, from this meeting the accountant told her she would need to submit tax returns for 2022 and 2023 despite only trading for a few months in 2022. She didn't get the paperwork straight to the accountant (she told us she left the initial meeting slightly confused!) She then received a £100 fine from HMRC, she promptly paid, got the paperwork to the accountant and let the accountant know she had received a fine.

She discovered in late February 2024 that only the tax return for 2023 had been submitted, leading to an additional £660 fine. When she asked the accountant why she had received the fine, the accountant advised she would be able to appeal it and there was a good chance she would get the money back. She then asked the accountant more information so she could write her appeal however, but never heard back from the accountant.

When we met with Katy, she was understandably upset and frustrated, not just for herself but with the issues her husband's business was having to deal with. We went through what Katy's business did, how she liked to operate and supported her in writing the appeal to HMRC.

See Katy's Cashtrak testimonial below.

Jordan Craythorne, Craythorne Electrical

Jordan and Katy are married and used the same accountant initially. The accountant had told him he need to register for VAT in January 2024. The accountant then registered for VAT on Craythorne Electricals behalf. Jordan had sent the accountant paperwork and was chasing to check the VAT registration had gone through OK but he didn't hear back from the accountant. With the problems Katy was facing, Jordan decided to look for another bookkeeper/ accountant and came to us in May with Katy.

During our initial meeting we realised that the accountant had registered Craythorne Electrical for the incorrect date, it was over a year late and the incorrect scheme. This meant the VAT bill was much higher than Jordan was expecting.

We spent time with Jordan to understand the business, his circumstances and financial goals and set out a clear and concise plan for the bookkeeping. We then went through all the paperwork and discussed what the accountant had told him. We were then able to let him know which VAT date he should have used and the best type of scheme for his business. We then supported him with what he would have to explain to HMRC and the best way of wording the email to change the registration and scheme.