Practical guidance for every stage of your sole trader journey – from side hustle to long‑term success.

Starting as a sole trader is one of the simplest ways to begin trading in the UK, but it’s important to understand what’s involved before you start.

Key things to consider:

A sole trader is personally responsible for the business and its finances

You keep full control, but you’re also responsible for tax and record‑keeping

You’ll usually need to register with HMRC once you start earning

Top tips before you start:

Check whether a sole trader structure is right for your goals

Budget for tax from day one

Open a separate business bank account early

Keep things simple – you can refine systems later

👉 If you’re unsure where to start, getting advice early can save time and money later.

Essential start‑up tips:

Register for Self Assessment with HMRC on time

Keep records of all income and expenses from day one

Use simple bookkeeping software or spreadsheets

Understand your key deadlines

Common early mistakes to avoid:

Mixing personal and business finances

Leaving bookkeeping until the end of the year

Not setting money aside for tax

Not fully researching your options

💡 Tip: Spending a little time each week on bookkeeping prevents big headaches later.

Tips for established sole traders:

Review your income and expenses monthly

Check whether you’re claiming all allowable expenses

Monitor cash flow, not just profit

Review pricing annually to reflect rising costs

Plan ahead for tax payments

As your business grows, your bookkeeping and tax responsibilities often become more complex — regular reviews help you stay ahead.

Struggling with Tax Returns?

You’re not alone. Many sole traders find tax returns stressful, especially if bookkeeping has been left until the last minute.

Common issues we see:

Missing or incomplete records

Unclaimed expenses

Confusion over tax and National Insurance

Worry about penalties or HMRC enquiries

How to make tax returns easier:

Keep digital copies of receipts

Reconcile your bank regularly

Don’t wait until January to prepare your return

Ask for help if you’re unsure

Spreadsheets are no longer enough. HMRC’s Making Tax Digital (MTD) rules now require most sole traders to keep digital records and submit quarterly updates and if you dopn't already, you will have to soon. Beyond staying legal, the right software turns a "box of receipts" into a real-time dashboard for your business.

The Benefits of Going Digital:

Real-Time Tax Estimates: No more "January surprises"—know exactly how much to set aside for HMRC every month.

Automatic Bank Feeds: Your transactions flow directly into the software. No more manual data entry.

Professional Invoicing: Create, send, and track invoices from your phone the second a job is finished.

Claim Every Penny: Snap photos of receipts on the go so you never miss an allowable expense again.

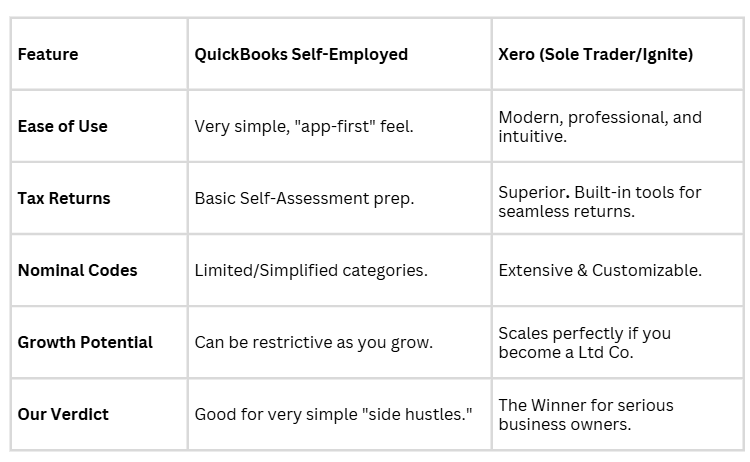

QuickBooks Self-Employed vs. Xero: Which is right for you?

While we can work with most platforms, we have a clear favorite for our clients. Here is how the two leading packages for sole traders compare:

Why We Recommend Xero

At Cashtrak, we prefer Xero because it is built for accuracy and growth. The two biggest reasons come down to how we manage your year-end:

Detailed Nominal Codes (The "Secret Sauce" of Good Bookkeeping)

A "Nominal Code" is simply a category for your money (e.g., Materials, Travel, or Marketing).

The Problem with QuickBooks Self-Employed: It uses very broad categories. This makes it hard to see exactly where your money is going.

The Xero Advantage: Xero provides a much deeper "Chart of Accounts." This allows us to track your spending with precision. For example, instead of just "Travel," we can see "Fuel," "Train Fares," and "Parking" separately. This data is vital for making smart business decisions.

Stress-Free Tax Returns

Xero is designed to "talk" to HMRC more effectively. Because the data is organized into those detailed nominal codes mentioned above, mapping your figures to your Self-Assessment tax return is significantly faster and more accurate. This reduces the risk of errors and ensures you are claiming every allowable expense possible.

Common Sole Trader Queries

Understanding Tax & National Insurance

As a sole trader, you’ll usually pay:

Income Tax on your profits

Class 2 and Class 4 National Insurance

These are reported through your annual Self Assessment tax return.

Key deadline to remember:

31 st January – online tax return and tax payment

VAT – When Should Sole Traders Think About It?

You must register for VAT if your taxable turnover exceeds the VAT threshold, but voluntary registration may be beneficial in some cases.

VAT may be worth considering if:

You work mainly with VAT‑registered clients

You want to reclaim VAT on expenses

Your business is growing quickly

Choosing the right VAT scheme can have a big impact on cash flow.

💡 Tip: Setting aside money monthly for tax helps avoid large, unexpected bills.

Simple Cash Flow Tips for Sole Traders

Even profitable businesses can struggle with cash flow. Practical tips:

Invoice promptly

Track who owes you money

Follow up overdue invoices

Review your bank balance weekly

Plan ahead for quiet periods

Good cash flow management keeps your business running smoothly.

When Should You Get Professional Support?

You may benefit from professional help if:

Your tax returns feel overwhelming

Your business is growing

You want reassurance that everything is compliant

You’d rather focus on running your business

💡Tip: Professional bookkeeping and tax support can pay for itself.

By reducing mistakes, avoiding penalties, and maximising allowable expenses, it can save you more money than it costs.

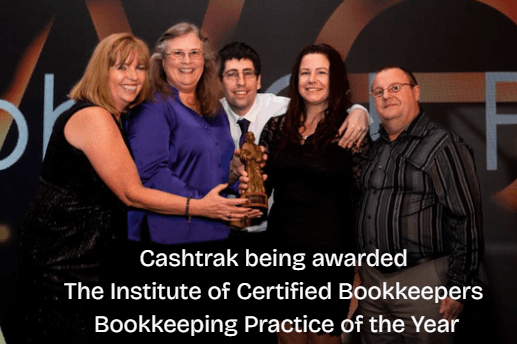

How Cashtrak Can Help Sole Traders

Cashtrak supports sole traders at every stage of their journey, including:

Getting started and registering with HMRC

Practical business guidance and advice

Bookkeeping and VAT support

Self Assessment tax returns

Payroll and CIS (where required)

Accounting software setup and support

Ongoing compliance and peace of mind

Support with growth and scaling your business