Get The Most From Cashtrak

& Your Software

We have compiled a checklist of options available for your set up with Cashtrak.

Xero is flexible, we can edit & personalise areas. Not everything on this list will necessarily be required for your business and not everything has been added here as there are a lot of options! If there are any areas that are of interest to you which we have not yet discussed, please do not hesitate to contact us & we'll be happy to explain how these areas can be utilised for your business.

Hubdoc is a fantastic tool to streamline your supplier invoices (bills) & receipts.

Use the items below to jump to an area of interest. Prefer to contact us to talk through? Use the buttons below.

Utilising and Personalising Xero For You

Your logo will be added to your Xero dataset and will be displayed on invoices and other official communications from Xero.

If you have more than one logo because you work with different brand names, or have different sections of the business, we can assist with simplifying that.

Therefore, please send all logos you have and advise us which is to be the main default logo. See below for details on branding themes.

Using your business logo adds a layer of professionalism and brand consistency that can significantly enhance your company's image. It creates a cohesive and recognisable identity, reinforcing your brand every time an invoice, statement, or report is generated. This not only instills trust and credibility with clients but also fosters a sense of pride and ownership among employees. Moreover, customised accounting documents with your logo help differentiate your business from competitors, leaving a lasting impression and ensuring that your brand remains top-of-mind for clients and partners.

Internal Users

Please advise the names and email addresses for all of the staff or subcontractors you wish to have access to Xero.

Xero allows for different user access (click here for more information on which roles are available.) We will give everyone full access unless advised otherwise. Full access means the user see the bank accounts and run profit reports. If you have specific requirements or need any further guidance with the roles.

Multi-Currency

Xero is able to manage multiple currencies, however this feature is an additional fee per month.

Multi-currency converts international business transactions for you and records them in your accounting software making reconciling foreign currency invoices much quicker and easier. You can view reports in any currency to see how the business is performing internationally as well as seeing exchange rate and foreign currency markets affect your cash flow or profit.

Please contact us to discuss your requirements if you feel this would be of benefit to you and let us know which currencies you would like to use.

If you have already advised us that you want multi-currency, this will be available to use straight away.

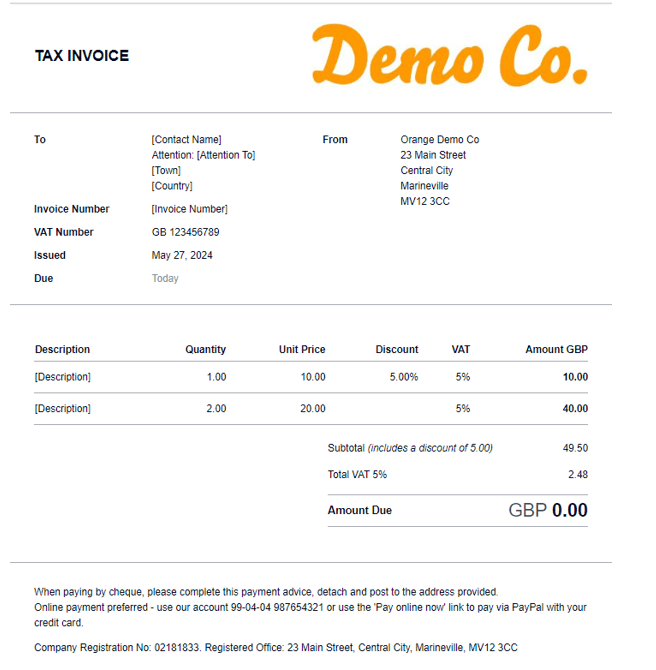

It's possible to have more than one invoice layout, you can tailor the look of the invoice depending on your requirements and whether you are VAT registered or not, or a limited company versus a sole trader.

This is an example of the default layout below, also at the foot is a list of things that can easily be changed. Please advise your thoughts giving details on things to change for your requirement where applicable.

It is important you include as much information as possible on your invoice to assist your clients and ensure problem-free payments.

We can set up and automated payment collection via direct debit for your invoices, even if dates and amounts change. These can be used for one off or recurring payments and allows your payments to be collected, hassle-free, cutting down on credit control. If you would like to use an automated payment collection add on like GoCardless, please let us know.

Editable Fields

Logo can be on the left or the right

The word Tax Invoice is the factory default, this can be changed, a lot of clients just invoice

If you need to use Proforma Invoices, let us know and we will explain the workaround and processes for this

Please advise if you wish to add phone numbers, emails, and/or websites listed under the address in the FROM section

The columns can be rearranged or removed to suit

The wording regarding payment can be set to be different for each invoice layout we design. It is good to show your own house style here, ensuring the wording is in your voice, not the default or even the Cashtrak way of saying it. If, for example

you only want people to pay by credit card we can use: 'to pay please use link provided'

you may have different bank accounts for different items you sell, if so please advise which is which so we can make the changes

you have a direct debit system in place you may just wish to add 'this is for information and record keeping purposes only'

You may wish to have a 'thank you for your business'

Email Addresses

No matter who issues the invoice, it's possible to appear as if it comes from a specific email address, eg accounts@abc.co.uk.

This is easy to set up, all you need to do is let us know which email address to use and we can arrange it.

Please note if you wish us at Cashtrak to assist with issuing any invoices for you, we recommend that you ensure you have one of your email addresses programmed or the clients will see our email address and it may cause confusion.

Invoice Line Items – Avoid Adding The Same Information and Save Time

We can program Xero so that you only need to type one word in to the invoice and a set description appears, saving you the time to type the same things out time and time again.

We have created a spreadsheet template for you to download and add the data then email to us. We will use the data you provide to populate your dataset for you.

Please see the notes in the spreadsheet to explain what information we need and why. Please note, the final column for sales price is not compulsory, but you can utilise it if that helps, especially if you sell by the hour or have physical products at set prices.

Wording

You can issue quotes from Xero, the details you give for the invoices will cover most of the requirements for these. We will just need details on the expiry of your quotes to add the relevant note.

It is possible to add more notes, so please advise us on how you presently word your quotations and we can assist in moving that over.

Reference Numbers

We can tailor the way your quotation and invoice numbers look. Maybe you just use a number system, or you may prefer INV or QU in front of the number.

Please let us know if you wish to start a fresh or carry on with your current system and we can ensure that we program in the correct starting point.

Crezco

This is a free to use facility.

Crezco is an open banking payment solution for online invoice payments up to £1,000,000. Get paid sooner, for free, by offering your customers a secure and convenient checkout solution that automatically adds a payment link to your invoices, ensuring you are paid on time to the correct bank account.

By using Crezco to collect payments, on average you get paid 7 days faster and you can save on payment fees (depending on your bank.)

Let us know if you would like this as we can set it up for you. All you need to do is log on with a link we will send you and connect it to your own bank. We take care of the rest.

Gocardless

If you have a business where you have regular work with the same client, you may wish to collect the money through the direct debit system. This was generally only available to large companies and had to be set up through your bank, and took time to do so.

Gocardless have opened this up for smaller businesses at a much smaller charge than the banks. You take control of when you get paid and cut out the stress of following up with debtors.

If you have a website for your sales you can also link them together for a smooth payment solution. The fees for the basis offering are:

1% of the invoice value + £0.20 per transaction capped at £4 for transactions below £2,000

1.3% of the invoice value + £0.20 per transaction capped at £4 for transactions above £2,000

2% of the invoice value + £0.20 per transaction capped at £4 for international payments.

There is a small extra charge for other benefits, which we can talk about should you wish to take up this solution. Please let us know if you are interested.

Invoices

When an invoice is sent from Xero, it's possible to set up as many different versions of the wording as you wish. The link to the default wording is below.

Please let us know if you wish this to be changed for your requirements and if you wish more than one, tell us the name by which you need each set called.

Please note that we can set different defaults for different invoice themes if you wish these to be programmed in.

Payment Reminders

We can program the system to send automatic reminders to your clients that payment is due and can set multiple layers of these.

Once the invoice is X days overdue a polite reminder will be sent. Then again at Y days and so forth. Each occurrence can have different wording, becoming more and more firm with us able to set a reminder to go out stating the payment is overdue.

Please let us know the frequency and wording you would like to use. The link to the default wording is below.

Analysis Of Income Types

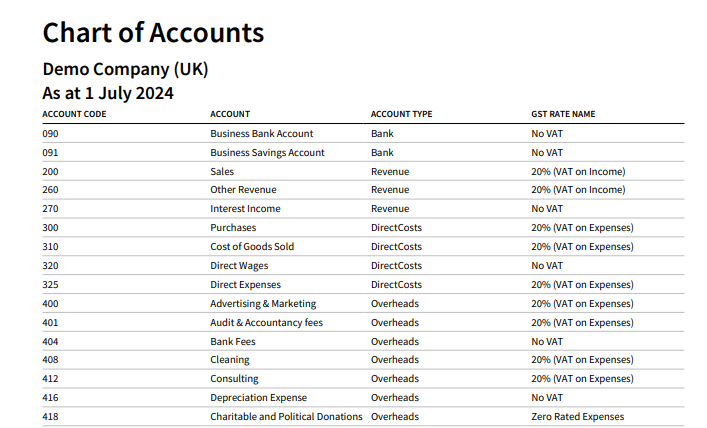

The Chart of Accounts is a comprehensive list of all the financial accounts in your company's general ledger, organised by categories such as assets, liabilities, income, and expenses. Each account is assigned a unique identifier known as a nominal code. These codes help categorise and track financial transactions efficiently. Having a well-structured Chart of Accounts with clear nominal codes is crucial for accurate financial reporting, budget management, and strategic decision-making. It ensures that every financial activity is recorded correctly, providing you with a clear and organized view of your business’s financial health. These codes feed through to reports you will see such as your profit and loss.

If you feel it would be useful to understand how much income you gain from different parts of your business, we can arrange for this to be easily identified. For example, you could use bookkeeping as bookkeeping sales and payroll as payroll sales rather than using sales for both of them it then allows us to see how much we have in bookkeeping and how much in payroll.

If this is something of interest, please give us a list of your thoughts and we can discuss this in more detail to ensure it work smoothly for everyone.

If it is a very simply explained request the section below on the Chart of Accounts will enable you to add details.

Chart of Accounts

A chart of accounts is a financial organisational tool that provides a complete listing, by category, of every account in the general ledger of a company. Put another way, it is how you think of the income and expenditure of your business so you can easily monitor how you are doing.

The link to Chart of Accounts below is one of the Xero standard lists, please look at the wording and description. The description is there mainly as a memory aid for you to know what the “pot” is for and we can change this to whatever you want it to say so you understand what it is. We can even change the names of each pot to be in line with your own needs. Therefore, please place comments in the column at the end and we can tailor accordingly.

Feel free to change the name as well as we want this to be totally intuitive for you and your needs.

If you want to understand more on your chart of accounts, Xero's video below shows what it is, where to find it and what it means. The video does show you how to edit the codes, we ask that you don't edit any codes, just make notes based on this video you want to see and let us make changes if possible, this is because there may be a reason why a change may not work for you or your business.

Please remember not to make any changes, this is just to show you how to view the chart of accounts.

Once Xero is set up and you have started working through it, we can arrange for reports to be reworked to suit your requirements, we can even have these designed differently for each director should you want us to.

Please feel free to mention specific requirements now (if you know what you need), otherwise we will have a chat in the future to set this section up for you.

Getting Started With Xero

1) We need to get your financial information on to Xero. The easiest way to do this is to connect your business bank account(s), credit cards you use for business and payment systems you have in place (such as Stripe, Go Cardless, Zettle, Paypal etc.) We can upload from a CSV statement if online banks connection is not possible, we would need to talk your through what we need. Watch the video below to see how to do this or contact us and we can talk your through it.

2) Check your chart of accounts has the correct 'pots of money' that you want to see, these are easily added and amended if you want a 'pot' to be called something else. Click here to see how to do this.

3) Get your purchase receipts and invoices in to Hubdoc, this is the software we use to process your purchases in to Xero. Click here for how to do this.

4) If you are invoicing your customers using Xero, watch the video below to see how to do this.

Learn how to add and connect your bank account(s) below.

Learn how to create and send a sales invoice on Xero below.

Hubdoc

Introduction to Hubdoc for Your Business

Hubdoc is a powerful document management tool that helps businesses streamline their financial processes by automatically fetching, organising, and storing key financial documents. It integrates seamlessly with accounting software like Xero and QuickBooks, making it easier to manage receipts, invoices, and bank statements.

How It Works

Forward Email

Paperwork emailed to you can be forwarded to Hubdoc. You could set a rule in our email to do this automatically.

Scan/ Upload

If you have saved or scanned your paperwork, you can upload them directly to your Hubdoc account on your computer.

Hubdoc App

Snap a photo directly on the app.

Uploading Documents

Manual Upload

Click on the "Upload Document" button to manually upload receipts, supplier invoices (bills) & other financial documents from your computer or mobile device.

Email Upload

Send documents directly to your unique Hubdoc email address.

Mobile App

Download the Hubdoc mobile app from the App Store or Google Play. Use the app to take photos of your receipts & upload them directly to Hubdoc.