Tripcatcher – Capture Your Business Mileage Expenses Easily!

This week marked the last member of our practice making a business trip for the first time since the COVID-19 pandemic and she realised she hadn’t used Tripcatcher for a while so needed a refresher so we though it would be useful to share this.

What is Tripcatcher?

Skip to the refresher section if you already know!

You can complete your mileage expenses anywhere, using our mileage tracker which is available on the web or phone app.

It’s very easy to use, with lots of time-saving features including:

- Calculating the VAT your business can claim on the fuel portion of the mileage rate;

- Google Maps for calculating the distance travelled, favourites and recurring trips.

- Tripcatcher integrates seamlessly with leading cloud-based accounting software including Receipt Bank, Xero and Expensify – meaning we don’t just make it easy to create a mileage log; it’s also easy to share your log with third parties.

What Does It Integrate With?

- Xero

- Receipt Bank

- Expensify

- Crunch

Refresher

A quick refresher on how to use Tripcatcher:

Go to the log on page by clicking here

Click on Trips on the top menu:

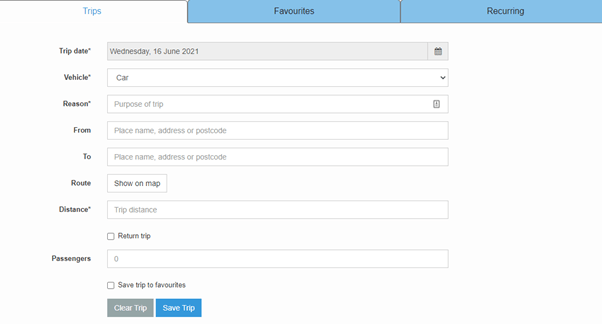

The details form will come up (see below) complete the information.

Note: you can type in any part of the address including the business name in the to or from field.

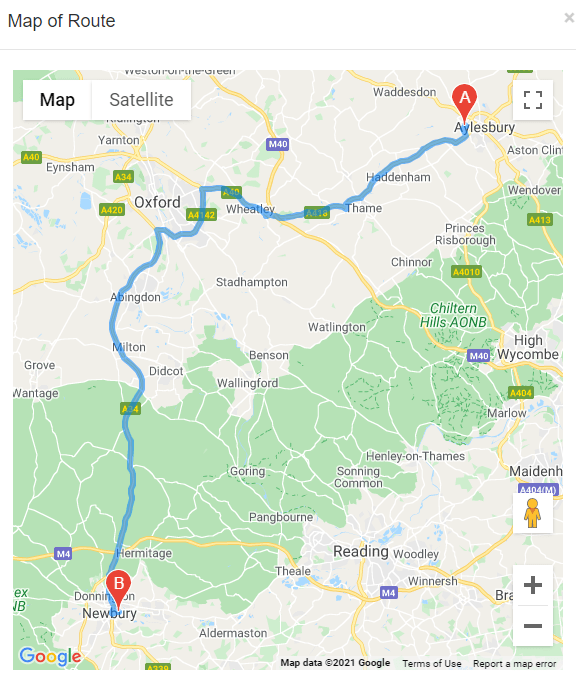

By clicking on the Route button, it shows the route it thinks you have taken on a map and therefore how the mileage was calculated. The mileage can be overwritten in the Distance field should you have gone a different way because of traffic for example.

Note: some businesses only pay mileage expenses above the normal mileage to the office so for example, if you live in Aylesbury and work in Stokenchurch, the average round trip is 36 miles therefore 36 miles should be deducted from the total. The normal mileage to the office should be agreed with your manager.

You can save trip to favourites to easily capture the mileage for future.

Click Save Trip

If you need to publish this to the integrated software, click on Expense Claim on the top menu

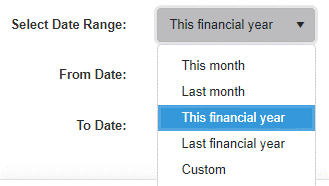

Select date range of the trip – you can select a specific time frame using the from and to fields or one of the options in the drop down menu:

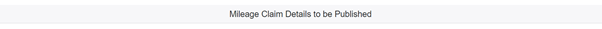

This will then show the trip(s) within this range under Mileage Claim Details To Be Published

Now click on the Publish Detailed Claim To (integrated software)

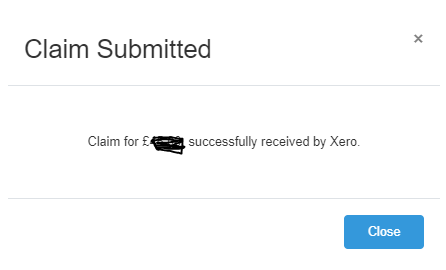

You will then get confirmation the claim has been received by the integrated software.

And that is it! You can also use an app to capture your mileage, for this and if you would a more comprehensive look at Tripcatcher and what it can do, please watch this video.